There is renewed incentive for mines in the Democratic Republic of Congo (DRC) to invigorate their decarbonisation efforts, as the country paves the way for taxing carbon emissions and regulating its carbon trading market.

It is therefore no surprise that discussions at the 2026 Investing in African Mining Indaba are likely to have a renewed focus on practical strategies for mines to steadily reduce their emissions over the coming years. With the passing of Ordinance-Law No. 23/007 in March 2023, the process is underway through which government will promote environmental conservation and meet its global carbon commitments.

According to Philippa Burmeister, partner and principal scientist in air quality and climate change at SRK Consulting (South Africa), it is only a matter of time before DRC mines’ carbon emissions will have direct financial implications. As a result, many companies are looking more closely at how they monitor their emissions, a crucial first step in managing and reducing these emissions.

To manage, first monitor

“The starting point in this process is to determine what the company’s most significant sources of greenhouse gases (GHGs) are, so that the biggest sources can be targeted first,” said Burmeister. “There are numerous technologies available, but not all technologies will be appropriate in all situations. Therefore, experience and practicality need to be applied in selecting technologies before implementation.”

An important consideration for mines in the DRC is to assess not only the potential impact of each particular technology but to evaluate the readiness of the support ecosystem for that technology to be applied, maintained, repaired and upgraded.

“While progress is being made with the development of low-emission equipment and vehicles, these might not yet be viable options locally if the mine’s production is unduly affected by long lead times for servicing and repair, for instance,” she said. “There needs to be a reliable supply chain to ensure the ready availability of technicians, mechanics, parts and technical infrastructure – to allow these innovations to achieve the necessary high levels of uptime in production.”

Proven technologies

Alexander Thin, director and principal mining engineer based in SRK Consulting’s Beijing office, reiterated the need for any new technology introduced into DRC to be well proven – ensuring that operational risk is effectively mitigated.

“Industry will be relying on the larger mining players who are pioneering technologies like hybrid trucks and electric equipment elsewhere in the world,” he said. “They will bring vital experience on how to apply and support these solutions, and will have the necessary insights into what the ecosystem needs to deliver.”

The mining industry’s decarbonisation journey also needs to be supported by developments in transport, energy and other infrastructure around the country, according to Wouter Jordaan, partner and principal environmental scientist at SRK Consulting (South Africa) – and also a director of SRK Consulting Congo. This will greatly facilitate the efforts being made by mines – and the opportunities open to them – as they pursue their decarbonisation agendas.

Scope for hydropower?

“The DRC is struggling to leverage its extensive potential in hydroelectric power, based on its substantial river system and conducive topography,” said Jordaan. “Unreliable supply leads to mines installing their own diesel-powered generation capacity – which exacerbates their carbon footprint.”

While mines can take steps to drive their decarbonisation journey, they could make faster progress if the national grid improved its reliability. Mineral commodity customers in regions like the European Union (EU) continue to strive toward zero carbon targets in their supply chains, and this is a growing pressure on mines in the DRC.

The EU’s Carbon Border Adjustment Mechanism (CBAM) aims to decarbonise carbon-intensive sectors by ensuring that imported goods face a carbon price equivalent to that of domestic EU production. This aims to prevent ‘carbon leakage’ and encourage cleaner industrial production globally. Carbon leakage occurs when companies based in the EU move carbon-intensive production abroad to countries where less stringent climate policies are in place.

“It is challenging for these mines to implement all the strategies they would like, when the necessary infrastructure is not supportive,” he explained. “The danger is that they can fall behind in their customers’ expectations, and have the potential to lose out on the export opportunities to areas like the EU – which would in turn have a negative knock-on effect on the DRC as a whole.”

Energy efficiency

He noted that there was considerable investment being made in road and rail infrastructure in the DRC, and this was also important in promoting decarbonisation. Where roads improve and rail services can start taking more of the load in terms of exports of minerals and imports of equipment and materials, this invariably introduces higher levels of energy efficiency.

“Where trucks can travel on smooth, tarred highways, for example, they are quicker and more efficient in terms of emissions,” he said. “Rail transport can be even more carbon efficient, especially when it is electrically powered by renewable sources. It is a more efficient mode of transport for bulk minerals and heavy equipment, and these improvements positively impact on the upstream and downstream supply chains of mines, where emissions must also be quantified.”

Most of the immediate decarbonisation progress that mines can make will depend on how well they control their energy usage on the mine site itself, said Burmeister, and how they generate power from lower-carbon sources.

Reduce and replace

“Every carbon action plan needs to consider both reduction and replacement of carbon-based energy,” she said. “Energy consumption needs to be reduced – such as through automated haulage and optimised ventilation – but you can only reduce to a point. Although these opportunities are low-hanging fruit in many cases, the real quantum leap comes with replacing fossil fuels as a source.”

She acknowledges that this is difficult, however, as the highest GHG emitter on mines tends to be diesel consumption of haulage and other mobile equipment. As yet, there is not an imbedded system with the necessary ecosystem to replace this completely.

Frank Li, director and principal geologist in SRK Consulting’s Beijing office, noted that electric haul trucks were already being used in fixed-route applications at harbours around China – with a simple battery-exchange process.

“As consultants, we will keep our eyes on these pioneering technologies and ensure that our mining clients know what it available and which ones could be relevant to their needs,” said Li.

To make progress in this context, Thin argued that the optimisation of the mining process – conducted as a key aspect of developing a mining plan – needs to be conducted with a high degree of innovative thought. This could open doors for more established technologies to be applied in conditions not previously considered suitable.

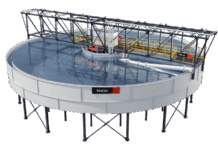

“For instance, the installation of trolley-assist haulage could be considered and modelled very early in the planning process – to establish whether it is viable,” he explained. “It may not be completely optimal within the traditional priorities of mining – but we are now in an era where decarbonisation is becoming more essential to the overall financial and ESG performance of mining operations.”